Research and development (R&D) tax credits are a government incentive designed to make innovation easier for startups and SMEs. However, the claim process can be overwhelming and without professional advice, small companies risk losing out on significant cash benefits.

We’re therefore delighted to feature Matthew Jones (ACA, CTA) in today’s blog, who is the Managing Director of LimestoneGrey, Wales’ leading chartered R&D tax credit consultancy. He answers some of your most frequently asked questions, including what activities qualify and if grant funding affects your ability to make a claim.

1. Do I qualify for R&D tax credits?

There are several factors to consider when reviewing a company’s eligibility for R&D tax credits:

-

The company set up

R&D tax credits are a form of corporation tax relief meaning it is only available to limited companies. It can be claimed regardless of whether a company is profitable or loss-making. Unfortunately, sole traders, partnerships of individuals, etc. are not eligible to apply.

-

The timeframe in which the R&D took place

Companies are against the clock to submit an R&D tax credit claim. You have two years from the end of the accounting period where the R&D took place to submit a claim. After this date, the claim will be lost, along with all financial benefits.

-

Evidence of qualifying R&D activity within their projects

The official definition provided by HMRC states ‘R&D takes place when a project seeks to achieve an advance in science or technology through the resolution of scientific or technological uncertainty.’

Most people scratch their head when they read this – so what does it mean in practice?

It is easier to understand if we split the definition into three parts and re-order them:

1. You need a project

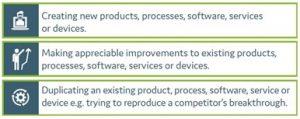

This may include any of the following activities:

2. The project needs to contain scientific or technological uncertainties

HMRC will not consider your project’s end result. Rather, they will consider the work your project involved and whether you had to overcome any difficult challenges. These challenges should be of a scientific or technological nature.

3. The project seeks to achieve an advance in science or technology

What is science or technology? Basically, it is knowledge. By overcoming the above scientific or technological uncertainties, you would have needed to advance this knowledge. An assessment needs to be made to determine if the solutions to the challenges were:

- Readily deducible by a competent professional in the field

- Available in publicly accessible information

This will determine if the advance in knowledge was solely in your company or industry-wide.

2. What can I claim for?

An R&D tax credit adviser will assess the following categories to identify costs within a qualifying project:

- Consumables (materials, water, light, heat, etc.)

- Payroll costs

- Externally provided workers

- Subcontractors

- Software

- Payments to any clinical trial volunteers

3. How much can I claim?

R&D tax credit relief was created by the Government in 2000 and has continued to get more and more generous since its inception. At present, a qualifying company can claim up to 33p for every £1 spent on qualifying R&D activity.

4. If I’ve received a grant, will that interfere with my ability to make a claim?

It is so important to stress that a company can still gain access to R&D tax credits if they have received a grant. This is one of the biggest misconceptions I hear from companies. The only factor that will be affected is the amount you are entitled to.

5. What should I look for in an R&D tax credit adviser?

It is no secret that HMRC are enforcing a variety of measures to prevent abuse of R&D tax credit relief following the recent identification and prevention of fraudulent attempts totaling over £300 million. Therefore, it is vital that you choose the right adviser as choosing the wrong one can potentially land you in very deep water.

My advice would be to:

-

Firstly, check the supplier’s credentials

R&D tax relief is a complex area of tax law and is not offered as standard by many mainstream accountants as it is not a compliance service. Due to its highly technical nature, it is imperative that your adviser has the necessary qualifications to undertake the work with the highest level of detail and accuracy. Ideally, you should work with a qualified chartered accountant (ACA or ACCA) or, even better, a chartered tax adviser (CTA). Having these qualifications indicates that they have passed the necessary exams and are regulated by professional bodies, enforcing them to follow strict codes of conduct.

-

Investigate the service level available

A full-service consultancy will take you through the entire R&D tax credit journey, from initial consultation to submission and beyond. However, this will not be the case with all suppliers. Some will force you to rely heavily on your own accountant following the preparation of the claim. These advisers tend not to be registered with HMRC and therefore cannot submit claims on your behalf.

-

Learn from others

Check the supplier’s website for any testimonials or case studies providing information on the experiences of other clients. I would recommend browsing their social media channels to see if they have published any good news stories or successes. Social media is also a good place to investigate whether the supplier has existing partnerships or relationships with any reputable organisations that would assure you of their integrity.

-

Get a second opinion

Most consultancies will provide a free no-obligation assessment of your company’s situation and advice on whether they feel it is worth pursuing a claim. I would recommend getting a second opinion as you have nothing to lose.

-

Finally, look out for unusual behaviour

When engaging with an R&D tax credit adviser, I would advise proceeding with caution if any of the following situations occur:

-

- The adviser alludes to the claim value in the initial meeting – it is impossible to say at this early stage without a full analysis.

- The adviser takes a blanket percentage of your employees’ wages to include in a claim – each employee will have spent a different amount of time on the project, so they need to be looked at in isolation.

- An adviser’s fee seems either too high or too low.

- The adviser ties you in with a long-fixed term contract (usually hidden later in the terms of the contract).

About LimestoneGrey

LimestoneGrey is a full service, chartered R&D tax credit consultancy, that is regulated by the ICAEW and CIOT, and only uses qualified professionals to conduct work on behalf of clients.