Smart Grants: Innovate UK makes £25 million available for disruptive innovations

Innovate UK has announced that a new round of Smart Grants will open on 28th May, with a deadline of 25th August 2021. £25 million will be available for disruptive R&D innovations that could significantly impact the UK economy.

Innovate UK has announced that a new round of Smart Grants will open on 28th May, with a deadline of 25th August 2021. £25 million will be available for disruptive R&D innovations that could significantly impact the UK economy.

Scope

Smart is Innovate UK’s "Open grant funding" programme. Applications can come from any area of technology and be applied to any part of the economy. This includes the creative industries, science or engineering, and the arts, design and media. Projects can overlap with the grand challenge areas, although Innovate UK is also keen to support projects in other areas.

Your proposal must demonstrate:

- A clear game-changing, innovative and/or disruptive and ambitious idea leading to new products, processes or services

- An idea that is significantly ahead of others in the field, set for rapid commercialisation

- A strong and deliverable business plan that addresses (and documents) market potential and needs

- A clear, evidence-based plan to deliver significant economic impact, return on investment (ROI) and growth through commercialisation, as soon as possible after project completion

- A team, business arrangement or working structure with the necessary skills and experience to run and complete the project successfully and on time

- Awareness of all the main risks the project will face (including contractor or equipment failure, recruitment delays, etc) with realistic management, mitigation and impact minimisation plans for each risk

- Clear, considerable potential to significantly impact the UK economy and/or productivity in a positive way

- Sound, practical financial plans and timelines that represent good value for money, which will always be a consideration in Innovate UK funding decisions.

Eligibility

Your application must include at least one SME; they can be the lead or a collaborative grant claiming partner. The project must start no later than 1 February 2022 and end no later than 31 January 2025.

Your project must also follow specific rules based on its duration:

- Projects with durations between 6 and 18 months must have total eligible project costs between £25,000 and £500,000. They can be single or collaborative projects.

- Projects with durations between 19 months and 36 months must have total eligible project costs between £25,000 and £2 million. In contrast to shorter projects, they must be collaborative.

RedKnight Consultancy has significant experience in supporting applications for Innovate UK Smart Grants. You can view one of our most recent success stories here. For our assistance in putting together a competitive proposal, please contact us today.

If you’re looking for further help, download our free application guide today! Drawing on our extensive experience with Innovate UK, it will take you through each of the application questions and explain what an assessor is looking for.

£7 million available for sustainable plastic packaging solutions

Innovate UK will invest £7 million in sustainable plastic packaging solutions in order to deliver the 2025 UK Plastics Pact targets. This funding is from the Smart Sustainable Plastic Packaging Programme, which is part of the Industrial Strategy Challenge Fund.

Innovate UK will invest £7 million in sustainable plastic packaging solutions in order to deliver the 2025 UK Plastics Pact targets. This funding is from the Smart Sustainable Plastic Packaging Programme, which is part of the Industrial Strategy Challenge Fund.

Scope

Funding is available to address widely known problems related to plastic packaging for consumer products. Therefore, all projects should improve the sustainability of the plastic packaging supply chain and contribute towards delivering the targets of the UK Plastics Pact.

Projects can focus on one or more of the following themes:

- The minimising or reduction of plastic packaging

- Packaging suitable for reuse, refill and online delivery

- Sustainable solutions for film and flexibles

- Food grade recycled polypropylene and polyethylene

- Behaviour change leading to less packaging waste or higher recycling rates

- Solutions that address the UK Plastics Pact target for problematic or unnecessary single use plastic packaging items

However, this is not an exhaustive list and Innovate UK will also consider other innovative projects.

Eligibility

To lead a project or work alone, your organisation must be a UK registered business. You can collaborate with other organisations, including businesses, academic institutions, charities, and research organisations. In addition, you should conduct all project work in the UK and intend to exploit your results from or in the UK.

All projects must:

- Claim a grant between £200,000 and £4 million

- Start in early 2022 and end by 32 March 2025

- Last between 12 and 36 months

The Smart Sustainable Plastic Packaging competition is open from 18th May until 8th September. For more information or to submit an application, click here. If you’re looking for bid writing support, please contact us to arrange a free consultation.

Not the right opportunity for you? Subscribe to our free monthly newsletter in order to receive the latest opportunities direct to your inbox.

Funding available to develop solutions to fusion energy challenges

A new Small Business Research Initiative (SBRI) competition, funded by the UK Atomic Energy Authority, aims to encourage innovation in the fusion industry. Organisations can apply for a share of £2 million to develop solutions to fusion energy challenges in two key priority areas (outlined below).

This is phase 1 of a potential 2 phase competition, where only successful applicants from phase 1 will be able to take part in phase 2. However, a decision to proceed with phase 2 will depend on the outcomes from phase 1 and assessment of a separate application into a subsequent phase 2 competition.

Scope

Your proposal must demonstrate the feasibility of your project and relate to one of the key priority areas:

1) Accelerating fusion power plant design with next-generation digital tools

2) Reducing fusion power plant fuel requirements with advanced production and handling technology for Hydrogen isotopes

For more information on what this should involve, click here. Innovate UK will prioritise applications that help the innovation be formally accepted for future use in a fusion plant environment, for example by obtaining relevant regulatory certificates or approvals during phase 2. In addition, they will favour innovations that consider sustainability as part of their technology development.

Eligibility

- Firstly, phase 1 contracts must have total costs between £50,000 and £250,000, inclusive of VAT.

- Projects can last up to six months; they should start by 1st September 2021 and end by 31st March 2022.

- Contracts will only be awarded to a single legal entity. However, you can employ specialist consultants or advisers if you can justify subcontracting components of the work.

The competition is open from 17th May until 30th June. You can find more information on the competition page. Alternatively, to discuss an application with one of our innovation funding specialists, please contact us today.

Not the right opportunity for you? Sign up for our free monthly newsletter in order to receive the latest competitions direct to your inbox.

Biomedical Catalyst 2021: £18 million available for innovative life science companies

Innovate UK will reopen the Biomedical Catalyst on 7th June 2021. UK-registered companies will be able to apply for a share of £18 million to develop their novel healthcare products, technologies and processes.

The Bioindustry Association (BIA) has welcomed the announcement of additional funding. Steve Bates OBE, Chief Executive, said:

“The Biomedical Catalyst is a key source of early-stage funding for UK bioscience companies to help them scale scientific ideas into products and therapies for patients. We are delighted that the Government, UKRI and Innovate UK have listened to the life sciences community and see the benefit of pump priming the translation of UK life science innovation into economic benefit for the nation in continuing to support this tried and tested programme.”

Background

The Biomedical Catalyst is a funding programme with three key objectives:

- Deliver growth to the UK life sciences sector

- Deliver innovative life sciences products and services into healthcare more quickly and effectively

- Provide support to academic and commercially led research and development

An Ipsos MORI report concluded that the Biomedical Catalyst has successfully met its objectives. Since its inception in 2012, It has offered strong value for money, increased companies’ R&D investment by 93%, and increased employment by 11 to 15 percent over 3 to 5 years.

Scope

This competition combines the early and late-stage strands of the Biomedical Catalyst. The aim of an early-stage award is to create a data package that is sufficient to support the testing of your product or process in a clinical setting or another relevant environment. In contrast, the late-stage award is designed to test a well-developed concept and show its effectiveness in a clinical setting or another relevant environment. It should therefore build on prior credible research on a product prototype or process.

Projects can focus on any health and care sector or discipline, for example:

- Medical technologies and devices

- Stratified healthcare

- Advanced therapies (gene and cell therapies)

- Digital health

- Drug discovery

- Diagnostics

In particular, Innovate UK will welcome applications that support innovation in the following areas: child health technologies; innovations that support clinical trials in the UK; biomedical innovations that combat the threat of antimicrobial resistance.

Eligibility

Firstly, your project must have total eligible costs between £250,000 and £4 million. It should start from 1st April 2022 and last between 12 and 36 months. To lead a project or work alone, your organisation must fulfill the following criteria:

- Be a UK registered SME

- Carry out its project work in the UK

- Intend to exploit the results from or in the UK

You can collaborate with the following types of organisation: UK-registered businesses of any size, academic institutions, charities, not-for-profits, public sector organisations, or research technology organisations. However, large companies will not be eligible for grant funding.

This competition closes on 26th August 2021. If you’re looking for bid writing support, please contact us to arrange a free consultation.

Subscribe to our monthly newsletter in order to receive the latest competitions direct to your inbox.

Funding available for hydrogen transport demonstrations

Innovate UK has announced a new competition to demonstrate the use of green hydrogen in transport. The competition is funded by the Department for Transport as part of the UK Government’s ambition to build a fully operational hydrogen transport hub by 2025.

Up to £2.5 million is available for demonstrations of hydrogen-powered vehicles in real-world operational settings across Tees Valley. The competition aims to further the UK’s understanding of how hydrogen can support the long-term development of the Tees Valley Hydrogen Transport Hub (HTH), subsequently driving demand to decarbonise the transport system.

Eligibility

Firstly, all projects should have total eligible costs between £200k and £1 million. They should start by 1st September 2021 and end by 31st March 2022. To lead a project, your organisation must be registered in the UK and work in collaboration. Lastly, you should carry out all project work and exploit your results from or in the UK.

Scope

All applicants must use a hydrogen vehicle or vessel in an operational setting to replace, complement or add to existing transport fleets or operations. While projects can operate vehicles partly outside the Tees Valley, they must maintain their main logistical connection with the area.

In more detail, all projects must:

- demonstrate a green zero-emission hydrogen transport solution by 31 March 2022 for 3 months

- operate the demonstration in an open public setting or controlled environments, such as warehouses and distribution centres

- offer a method to track their solution against performance indicators against a baseline comparator to understand benefits or challenges and then deploy this solution as part of the demonstration

- report on the benefits for passengers, customers and residents in the Tees Valley

- develop plans for long-term activities to create a demand for hydrogen in the Tees Valley from 2022

As part of your project, you should also:

- undertake desk-based research into future engagement with the hub after 31 March 2022

- show how the activity proposed for 2021 to 2022 will support the hub’s longer-term ambitions

- outline how post-2022 activity will transition into a commercially viable ongoing hydrogen-fuelled transport activity or a larger trial on the ground encompassing hydrogen production and its wider use beyond transport.

- explore the policy landscape associated with the deployment of a specific hydrogen vehicle or vessel to help inform wider policy discussions

More Information

For more information, including the competition’s full scope and eligibility criteria, click here. Alternatively, please contact us if you’d like to discuss an application with one of our advisers.

Not the opportunity you’re looking for? Subscribe to our monthly newsletter to receive the latest competitions direct to your inbox, as well as a copy of our free Innovate UK application guide!

EIC Pathfinder Challenges 2021

The EIC Pathfinder provides funding for advanced research on breakthrough technologies. Alongside an open call for funding that closed on 19th May, the European Innovation Council (EIC) has announced five Pathfinder Challenges for 2021:

- Awareness inside (consciousness in AI systems)

- Tools to measure and stimulate activity in brain tissue

- Emerging technologies in cell and gene therapy

- Novel routes to green hydrogen production

- Engineered living materials

What are the Pathfinder Challenges?

Pathfinder Challenges provide a top-down funding opportunity that targets the EIC’s strategic priorities. Each challenge sets out to build on cutting-edge science and technology, leading to disruptive innovations grounded in high-risk research and development. With each challenge call, the EIC aims to establish a multi-disciplinary portfolio of projects which will be supervised by a dedicated EIC Programme Manager.

Who can apply?

Firstly, you should apply if you have a project idea that could contribute to the goals of one of the challenges. In contrast to the Open Call, the Pathfinder Challenges support applications from both consortia and single legal entities (unless otherwise stated in the specific challenge criteria).

What funding is available?

The total indicative budget for this call is €132 million which will be split across the five challenges. Typically, individual proposals should cost up to €4 million and the grant will cover 100% of your project's eligible costs. However, applicants can request larger amounts if there is a justifiable need for extra funding.

Further grants of up to €50,000 will be available to explore pathways to commercialisation or for portfolio activities. As well as this, successful applicants will receive access to a wide range of Business Acceleration services and be able to submit an EIC Accelerator proposal via a fast-track scheme.

More information

The call will open from 15th June until 27th October 2021. For more information on each of the challenges, such as specific eligibility criteria, download the EIC work programme. If you’re thinking of applying and would like bid writing support, please contact us to arrange a free consultation.

In addition, you can find alternative grant funding opportunities on our blog or in our monthly newsletter.

R&D Tax Credits: A Q&A with LimestoneGrey

Research and development (R&D) tax credits are a government incentive designed to make innovation easier for startups and SMEs. However, the claim process can be overwhelming and without professional advice, small companies risk losing out on significant cash benefits.

We're therefore delighted to feature Matthew Jones (ACA, CTA) in today's blog, who is the Managing Director of LimestoneGrey, Wales' leading chartered R&D tax credit consultancy. He answers some of your most frequently asked questions, including what activities qualify and if grant funding affects your ability to make a claim.

1. Do I qualify for R&D tax credits?

There are several factors to consider when reviewing a company’s eligibility for R&D tax credits:

-

The company set up

R&D tax credits are a form of corporation tax relief meaning it is only available to limited companies. It can be claimed regardless of whether a company is profitable or loss-making. Unfortunately, sole traders, partnerships of individuals, etc. are not eligible to apply.

-

The timeframe in which the R&D took place

Companies are against the clock to submit an R&D tax credit claim. You have two years from the end of the accounting period where the R&D took place to submit a claim. After this date, the claim will be lost, along with all financial benefits.

-

Evidence of qualifying R&D activity within their projects

The official definition provided by HMRC states ‘R&D takes place when a project seeks to achieve an advance in science or technology through the resolution of scientific or technological uncertainty.’

Most people scratch their head when they read this – so what does it mean in practice?

It is easier to understand if we split the definition into three parts and re-order them:

1. You need a project

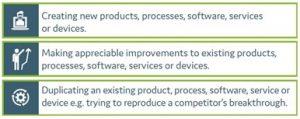

This may include any of the following activities:

2. The project needs to contain scientific or technological uncertainties

HMRC will not consider your project's end result. Rather, they will consider the work your project involved and whether you had to overcome any difficult challenges. These challenges should be of a scientific or technological nature.

3. The project seeks to achieve an advance in science or technology

What is science or technology? Basically, it is knowledge. By overcoming the above scientific or technological uncertainties, you would have needed to advance this knowledge. An assessment needs to be made to determine if the solutions to the challenges were:

- Readily deducible by a competent professional in the field

- Available in publicly accessible information

This will determine if the advance in knowledge was solely in your company or industry-wide.

2. What can I claim for?

An R&D tax credit adviser will assess the following categories to identify costs within a qualifying project:

- Consumables (materials, water, light, heat, etc.)

- Payroll costs

- Externally provided workers

- Subcontractors

- Software

- Payments to any clinical trial volunteers

3. How much can I claim?

R&D tax credit relief was created by the Government in 2000 and has continued to get more and more generous since its inception. At present, a qualifying company can claim up to 33p for every £1 spent on qualifying R&D activity.

4. If I’ve received a grant, will that interfere with my ability to make a claim?

It is so important to stress that a company can still gain access to R&D tax credits if they have received a grant. This is one of the biggest misconceptions I hear from companies. The only factor that will be affected is the amount you are entitled to.

5. What should I look for in an R&D tax credit adviser?

It is no secret that HMRC are enforcing a variety of measures to prevent abuse of R&D tax credit relief following the recent identification and prevention of fraudulent attempts totaling over £300 million. Therefore, it is vital that you choose the right adviser as choosing the wrong one can potentially land you in very deep water.

My advice would be to:

-

Firstly, check the supplier’s credentials

R&D tax relief is a complex area of tax law and is not offered as standard by many mainstream accountants as it is not a compliance service. Due to its highly technical nature, it is imperative that your adviser has the necessary qualifications to undertake the work with the highest level of detail and accuracy. Ideally, you should work with a qualified chartered accountant (ACA or ACCA) or, even better, a chartered tax adviser (CTA). Having these qualifications indicates that they have passed the necessary exams and are regulated by professional bodies, enforcing them to follow strict codes of conduct.

-

Investigate the service level available

A full-service consultancy will take you through the entire R&D tax credit journey, from initial consultation to submission and beyond. However, this will not be the case with all suppliers. Some will force you to rely heavily on your own accountant following the preparation of the claim. These advisers tend not to be registered with HMRC and therefore cannot submit claims on your behalf.

-

Learn from others

Check the supplier’s website for any testimonials or case studies providing information on the experiences of other clients. I would recommend browsing their social media channels to see if they have published any good news stories or successes. Social media is also a good place to investigate whether the supplier has existing partnerships or relationships with any reputable organisations that would assure you of their integrity.

-

Get a second opinion

Most consultancies will provide a free no-obligation assessment of your company’s situation and advice on whether they feel it is worth pursuing a claim. I would recommend getting a second opinion as you have nothing to lose.

-

Finally, look out for unusual behaviour

When engaging with an R&D tax credit adviser, I would advise proceeding with caution if any of the following situations occur:

-

- The adviser alludes to the claim value in the initial meeting – it is impossible to say at this early stage without a full analysis.

- The adviser takes a blanket percentage of your employees’ wages to include in a claim – each employee will have spent a different amount of time on the project, so they need to be looked at in isolation.

- An adviser’s fee seems either too high or too low.

- The adviser ties you in with a long-fixed term contract (usually hidden later in the terms of the contract).

About LimestoneGrey

LimestoneGrey is a full service, chartered R&D tax credit consultancy, that is regulated by the ICAEW and CIOT, and only uses qualified professionals to conduct work on behalf of clients.

Funding available to reduce the impact of offshore windfarms on UK air defence

The Defence and Security Accelerator (DASA) has announced Phase 2 of the Windfarm Mitigation for UK Air Defence competition. They will invest up to £3.6 million in innovations that permit the coexistence of offshore windfarms and UK air defence surveillance systems.

Background

Offshore wind is a key feature of the UK’s net zero future. In the 2019 ‘Net Zero’ legislation, the Committee on Climate Change predicted a requirement for at least 75GW of electricity from offshore wind by 2050 (Source: DASA). To achieve this, there will need to be a ten-fold increase in the UK’s current offshore windfarm generation capacity. However, this has the potential to negatively impact military air defence – thus, DASA is seeking innovations to make co-existence possible.

Eligibility

Applicants should recognise that this is the second phase of a multi-phase competition. While you don’t have to have been involved in Phase 1 to apply, you should be aware of the successful projects from the previous competition. In contrast to Phase 1, Phase 2 projects will reach a higher level of maturity. Individual proposals should not exceed £600k and, if successful, all work should be completed by 28th February 2023.

Scope

Proposals should address the challenge of maintaining the effective surveillance of airspace, despite the presence of larger windfarms. DASA is interested in alternative technologies that could fulfill one or more of the following objectives:

- Reduce radar clutter caused by offshore windfarms

- Ensure intruder detection in the vicinity of offshore windfarms

- Fill or remove gaps in radar coverage created by windfarms

Projects may involve some of the following components: alternative turbine materials; shaping of turbine materials; next generation or novel signal processing techniques; alternative technologies or combinations of these that would maintain the effective surveillance of airspace. In addition, the competition document contains a list of projects that DASA will not fund, including those that deliver technologies below TRL 4.

You can find more information in the competition document or contact us if you have any further questions. If this isn't the opportunity you're looking for, subscribe to our free monthly newsletter in order to receive the latest funding competitions direct to your inbox!

Mistakes to avoid in your innovation funding applications

In the UK, there is over £10 billion allocated for research and innovation funding each year. UK-based organisations can also apply for funding from the EU’s framework programme for research and innovation, Horizon Europe, which has a €95.5 billion budget for 2021-2027.

In the UK, there is over £10 billion allocated for research and innovation funding each year. UK-based organisations can also apply for funding from the EU’s framework programme for research and innovation, Horizon Europe, which has a €95.5 billion budget for 2021-2027.

However, applying for grant funding is complex and stressful, with a typical timeframe of 6 to 10 weeks to develop a strong application. Not only this, but the competition for grants is fierce; for example, the EIC Accelerator reported a success rate of just 2-3% in 2019-2020 (European Commission).

Our mission here at RedKnight is simple; we want to make the innovation funding process easier for tech-based startups and SMEs. As a result, we’ve created a list of the most common mistakes we see in grant applications. We hope that knowing what to avoid will increase your chances of success, making your hard work worth it!

1. The project isn’t within the scope of the funding programme

Ensuring your project is in scope is critical. Before you begin an application, you should always read the competition scope carefully and consider how your project addresses the specific areas of interest. You should ensure that your innovation is at the right stage of development and, if required, that you’re working in collaboration.

Remember that square pegs don’t fit round holes! If your project isn’t quite within the competition scope, it will be ineligible for funding and may not even be assessed. In this scenario, it’s preferable to consider alternative competitions.

2. You haven’t identified a clear challenge that your innovation will solve.

Your application needs to tell a story; what challenge will your innovation solve? In other words, you should explain why it is a necessary solution to a problem and warrants funding. You should support your argument with quantifiable statistics and provide a clear explanation of the nearest state-of-the-art available.

It’s also important that you don’t make your solution too far-reaching. While it might have wider applications, a specific area of focus can make the need for your innovation much clearer.

3. You’re applying alone, but a partner could strengthen your application.

Ask yourself the following questions: i) do you have the in-house skills to achieve what you are setting out to do? and ii) based on your track record, are you able to convince the evaluators that you can deliver the project?

If you answered no to one or both questions, you may want to consider working with a partner whose skillset and experience complements your own. This won’t go against you – in fact, it will strengthen your application! The assessors will have more faith in your ability to deliver the project.

4. You haven’t backed up your claims.

You need to substantiate the statements you make with evidence – the more detail, the better! For example, if you claim that there is a large target market for your innovation, you need to show the assessors how you know this. Therefore, you should include current market data references where possible to support your argument.

We hope this post helps you to avoid the most common mistakes we see in grant funding applications. If you’re applying for an Innovate UK Smart Grant, you can download our free application guide today. Alternatively, if you’re looking for further bid writing support, please get in touch.

Innovation loans available for SMEs

From 26th April, SMEs can apply for innovation loans from Innovate UK. These loans are for highly innovative, late-stage projects with strong commercial potential. Applications can come from any area of technology and be applied to any part of the economy.

Innovate UK’s pilot programme of innovation loans started in 2017. Through seven competitions so far, the programme has provided £80 million to over 100 successful applicants! In addition, Innovate UK approved £77 million in innovation continuity loans to nearly 100 SMEs as part of the UK Government’s coronavirus response package.

Eligibility

Innovation loans of between £250,000 and £1.6 million are available for experimental development projects. They can last up to 4 years, including both the R&D and commercialisation phases, and should start by September 2021.

To take on an innovation loan for a project, you must fulfil the following criteria:

- Be a UK registered SME

- Intend to exploit the results from or in the UK

- Give evidence that your business is suitable to take on a loan

Please note that individuals, academic institutions, research organisations and large companies are ineligible for innovation loans.

Scope

The competition aims to help SMEs make their innovations a successful, commercial reality. Innovate UK will evaluate your application on two grounds: firstly, the quality of your project proposal and secondly, the suitability of your business to receive a loan. Therefore, your proposal must demonstrate:

- an appropriate and evidenced loan request

- a clear route to commercial success with potential to make a significant and positive impact on the UK economy and productivity

- realistic, significant potential for global markets

- a strong management team

- why you are unable to fund the project from your own resources or other forms of public or private-sector funding

This competition is open from 26th April until 2nd June. If you have any further questions or would like support with your application, please get in touch.

Subscribe to our free monthly newsletter in order to stay up to date with the latest innovation funding opportunities.